What Appliances Qualify for Energy Tax Credit?

.webp)

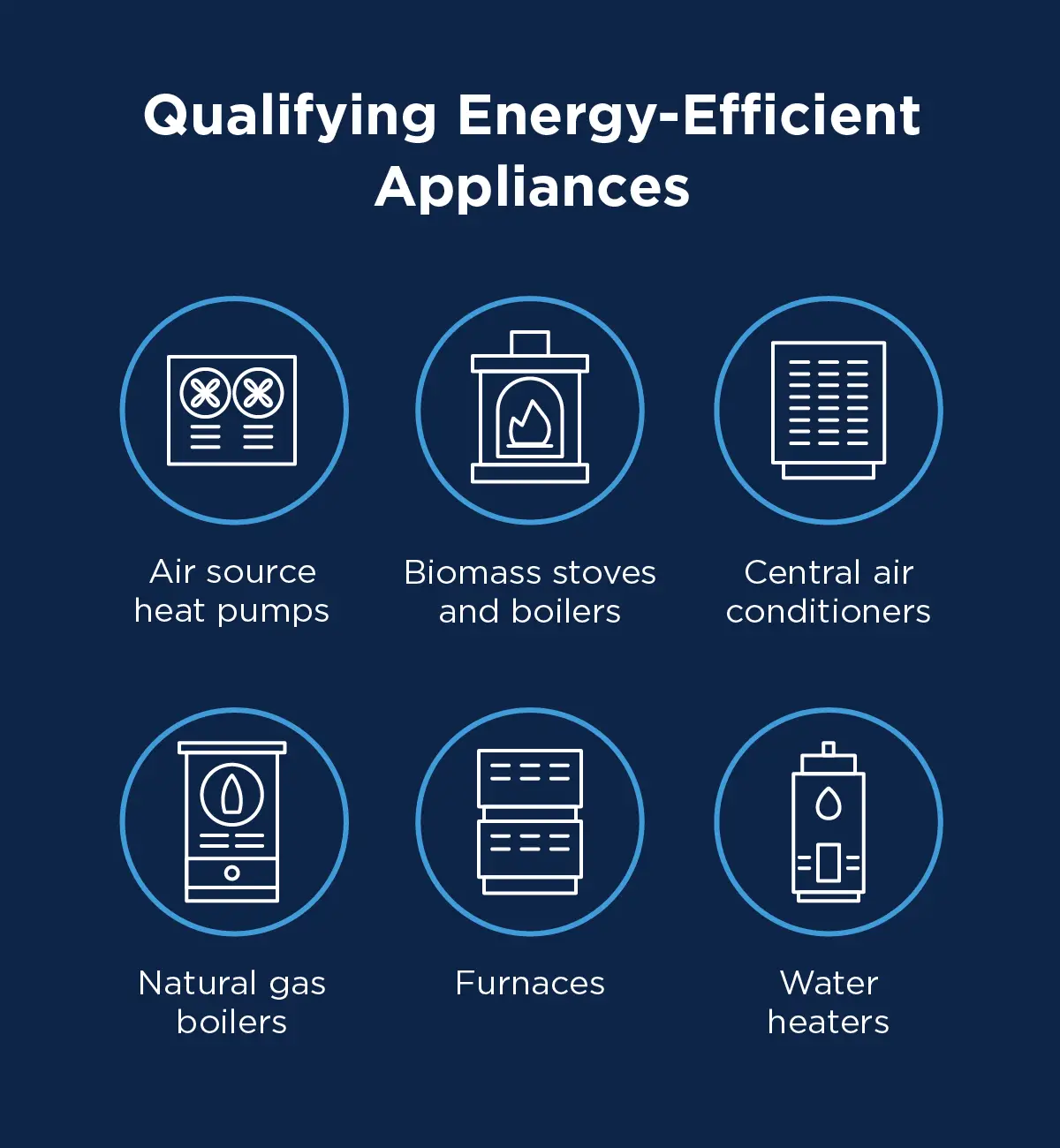

There are several energy-efficient systems that are eligible for an energy tax credit, including, biomass stoves and boilers, air source heat pumps, water heaters, natural gas boilers, furnaces, and central air conditioners. You may also be able to get a federal tax credit for renewable energy systems that run these systems.

Wondering what qualifies for the energy tax credit?

While small appliances like dishwashers or dryers don't qualify for federal tax credits, larger energy-efficient and renewable energy systems may be eligible.

Upgrading or installing new solar panels, a wind power system, and geothermal heat pump may qualify you for a tax break of up to 30% off the overall cost. Larger energy-efficient HVAC systems, including water heaters, heat pumps, furnaces, and central air conditioners, may also be eligible for credit under the Inflation Reduction Act.

We’ll review energy tax breaks for homeowners, what HVAC systems qualify for energy tax credits, how to file your claim, and how Aire Serv® will help install and maintain your energy-efficient system to maximize your tax return and energy savings.

Key Takeaways

- The tax credit amount is limited to 30% of qualified expenses, with a maximum annual claim of $600 per household or up to $2,000 for heat pumps and biomass stove or boilers, depending on the specific system.

- The new federal tax credits will remain in effect for appliances purchased and installed through December 31, 2032.

- File your federal income tax claim by filling out IRS Form 5695 (Part II).

Qualifying Energy-Efficient Systems

The Inflation Reduction Act rewards Americans for making their homes and other buildings more energy-efficient through tax incentives. While tax credits and deductions are available for home improvements such as installing insulation and energy-saving windows and doors, energy-efficient HVAC systems that meet certain criteria are also eligible.

Switching to a more energy-efficient system reduces your environmental impact, energy demand and costs, saving you money in the long run.

Tax Credits for Energy-Efficient Systems

The new federal tax credits began January 1, 2023, and will remain in effect for systems purchased and installed through December 31, 2032. The credit amount is limited to 30% of the project cost, with a maximum claim of $600 per household or up to $2,000 for heat pumps and biomass stove or boilers. Your specific credit will depend on the type of system you choose and where you live.

To claim energy tax credits, you have to fill out and submit special forms when filing your federal income tax return:

- Use Form 5695 to claim the Energy Efficient Home Improvement Credit and Residential Clean Energy Credit. You have to claim the credit for the tax year when the system was installed (not just purchased).

- Use Form 8911 to calculate your credit for Alternative Fuel Vehicle Refueling Credit. Individual taxpayers may not need to complete or file the form — review the instructions for details.

Certain eligibility requirements apply depending on the program, so it’s wise to consult a tax professional if you’re unsure if you qualify.

But first, we'll review a few important tax credit definitions to help you determine whether your system qualifies:

- Energy efficiency ratio (EER2) measures the average rate of delivered space cooling to the average rate of energy consumed.

- Seasonal energy efficiency ratio (SEER2) is the total heat removed from a space during the warmer months divided by the total energy consumed by the system during the same time period. The higher the SEER2 rating, the more efficient the system.

- Heating seasonal performance factor (HSPF2) is the total space heating required during the colder months divided by the total energy consumed by the system during the same period. This metric only applies to Iowa, Minnesota, Missouri, North Dakota, and South Dakota.

- Uniform energy factor (UEF) measures water heater efficiency. The higher the UEF rating, the more efficient the water heater.

Central Air Conditioners

ENERGY STAR-certified split air conditioning systems with SEER2 > 16 are eligible for a tax credit of 30% of the project cost, up to $600 annually. All packaged systems with an ENERGY STAR certification are also eligible.

Split air conditioners have two components — one outdoor and one indoor — connected by tubing. Packaged systems house both components in one place, usually in a single cabinet located outside the house.

Air Source Heat Pumps

For air source heat pumps, homeowners can claim 30% of the project cost, up to $2,000 annually. Product eligibility depends on the type of heat pump (ducted or ductless) and where you live (north or south). Refer to the Consortium for Energy Efficiency (CEE) climate region map to see what system is applicable to you and your home.

|

Air Source Heat Pumps That Qualify for Energy Tax Credit |

||

|

Ducted |

Ductless (Mini-Split) |

|

|

North |

Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 > 10 |

ENERGY STAR Cold Climate heat pumps with: SEER2 > 16 EER2 > 9 HSPF2 > 9.5 |

|

South |

Heat pumps with an ENERGY STAR label |

ENERGY STAR-certified heat pumps with: SEER2 > 16 EER2 > 12 HSPF2 > 9 |

Biomass Stoves and Boilers

Biomass stoves and boilers use biomass fuel — including wood, wood waste and residues, crops and trees, plants, and grasses — to heat a home or water. Biomass systems with a thermal efficiency rating of 75% or more are eligible for a tax credit of 30% of the project cost, up to $2,000 annually.

Natural Gas Boilers

You can claim 30% of the project cost, up to $600, for hot water boilers that use natural gas, oil, or propane. Both of these types must have an ENERGY STAR certification:

- Gas boilers: Gas boilers with an annual fuel utilization efficiency (AFUE) > 95% are eligible.

- Oil boilers: Oil boilers using certain fuels are also eligible. The manufacturer must rate the system for use with fuel blends at least 20% of the volume consisting of biodiesel, renewable diesel, or second-generation biofuel.

Furnaces

Natural gas and oil furnaces are eligible for a tax credit of 30% of the project cost up to $600 per year. Both of these types must have an ENERGY STAR certification:

- Gas furnaces: Gas furnaces with AFUE > 97% are eligible.

- Oil furnaces: Like boilers, oil furnaces using certain fuels are eligible. The manufacturer must rate the system for use with fuel blends at least 20% of the volume consisting of biodiesel, renewable diesel, or second-generation biofuel.

Water Heaters

Different types of water heaters are eligible for different tax credits, depending on where they draw their energy. Both heat pumps and natural gas water heaters must be ENERGY STAR-certified to qualify.

|

Heat Pump Water Heaters |

Natural Gas Water Heaters |

|

Claim 30% of the project cost, up to $2,000 for ENERGY STAR-certified appliances. |

Claim 30% of the project cost, up to $600 for ENERGY STAR-certified models, including:

|

Tax Credits for Energy-Efficient Home Upgrades and Improvements

Certain energy-efficient home improvements and upgrades are eligible for tax credits of 30% of certain qualified costs, up to $1,200. These improvements are not system-related, and instead include the installation of:

- Windows and skylights

- Doors

- Insulation

- Electrical panels

- Air-sealing products like weatherstripping and caulk

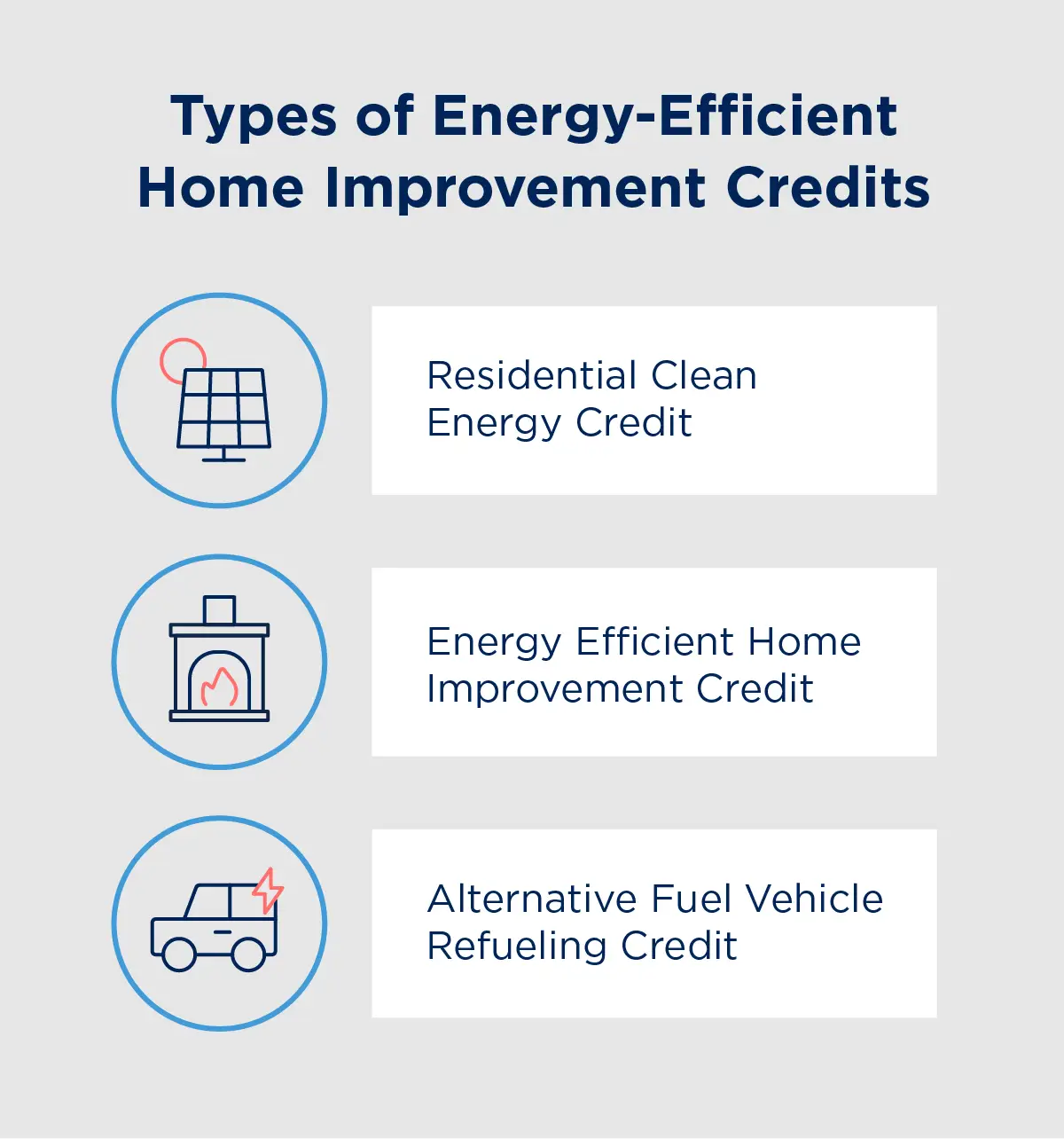

3 Types of Energy-Efficient Home Improvement Credits

Three programs are available for energy-efficient home improvement tax credits, all with different requirements and tax credit limits.

1. Energy-Efficient Home Improvement Credit

You may qualify for a tax credit of up to $1,200 per year if you made certain energy-efficient home improvements after January 1, 2023, through the Energy Efficient Home Improvement Credit. When combined with system upgrades, this credit can save homeowners up to $3,200 per year.

Some components of an energy-efficient system can qualify for tax credits, including:

- Heat pump upgrades: Electric or natural gas heat pumps with a 75% thermal efficiency rating or above are eligible for a credit of up to $2,000 per year.

- Water heater upgrades: Natural gas water heaters that meet the CEE’s highest efficiency tier qualify for a credit of up to $600 per item. Electric or natural gas heat pump water heaters with a 75% thermal efficiency rating or above are eligible for an annual credit of up to $2,000.

- Stove or boiler upgrades: Biomass stoves or boilers with a 75% thermal efficiency rating or above are eligible for a credit of up to $2,000. Natural gas boilers that meet the CEE’s highest efficiency tier qualify for a credit of up to $600 per item.

- Central cooling upgrades: Central air conditioning systems that meet the CEE’s highest efficiency tier qualify for a credit of up to $600 per item.

If you have a home energy audit conducted, you may also be eligible for a tax credit of up to $150. Specific requirements apply, so defer to the U.S. Department of Energy (DOE) for more information.

2. Residential Clean Energy Credit

You may be eligible for tax credits via the Residential Clean Energy Credit if you make renewable energy home improvements, including the installation of the following systems:

- Solar electric panels and water heaters

- Wind turbines

- Geothermal heat pumps

- Fuel cells

- Battery storage technology

You can claim up to 30% of qualified expenses — including the cost of the new equipment and some assembly and installation labor costs — through 2032, up to 26% through 2033, and 22% through 2034.

3. Alternative Fuel Vehicle Refueling Property Credit

You may also be eligible for significant tax credits if you install qualified vehicle recharging and refueling equipment in your home or business. This equipment must recharge electric vehicles or store or dispense clean-burning fuel for non-electric vehicles.

The qualifying property must also be in an eligible census tract. Check out the DOE’s tax eligibility locator to see if you qualify.

Qualified refueling equipment subject to depreciation is eligible for a 6% tax credit, up to a maximum of $100,000 for each piece of equipment. Qualifying equipment not subject to depreciation is eligible for a 30% tax credit, up to a maximum of $100,000 per piece.

How Do Tax Credits Work?

Tax credits reduce the amount of taxes you owe. This saves you money on taxes, in addition to the long-term savings you’ll receive from investing in a more energy-efficient system and home improvements. Here are a few key things to consider when applying for tax credits:

- You can claim energy tax credits when you file your federal income taxes, and the credit amount will generally be applied to your taxes due.

- The Energy Efficient Home Improvement and Residential Clean Energy Credits are nonrefundable, meaning you can’t get back more on the credit than you owe in taxes.

- The Alternative Fuel Vehicle Refueling Credit is generally a nonrefundable personal credit for individuals but may be treated as a general business credit if applicable.

Tax Credit vs. Rebate

Both tax credits and rebates reward individuals for making energy-saving updates to their homes.:

- Tax credit: You can claim tax credits when you file your annual tax return, reducing the amount you owe on your income taxes.

- Rebate: On the other hand, rebates essentially give you cash back after you make a purchase and aren’t dependent on income levels. You have to file an application to receive a rebate.

Smaller appliances like refrigerators and dishwashers are generally not eligible for tax credits, but they may qualify for certain manufacturer rebates.

As part of the Inflation Reduction Act, the High-Efficiency Electric Home Rebate Program, or Home Electrification and Appliance Rebates, allocates resources to each state’s energy office for distribution to residents. While these rebates are not yet available to households, some ENERGY STAR appliances may be eligible in the future.

Who Can Claim Home Energy Tax Credits?

Each energy tax credit program has different eligibility requirements. For the Energy Efficient Home Improvement Credit, which includes many system upgrades, basic eligibility requirements include:

- Improvements must be made to an existing home (not a new build or a rental).

- The home must be your principal residence (where you live most of the time).

- The home must be located in the U.S.

Basic eligibility requirements for the Residential Clean Energy Credit include:

- Improvements can be made to an existing or new home.

- The home must be your principal residence, whether you own or rent it.

- The home must be located in the U.S.

- You may also be able to claim certain improvements made to a second home in the U.S. that you live in part-time.

For the Alternative Fuel Vehicle Refueling Credit, qualifying equipment must be:

- Used to charge electric vehicles or store or dispense clean-burning fuel, including natural gas, ethanol, biodiesel, and others

- In original use with the taxpayer

- Used in the U.S. or U.S. territories

- Installed on property used as a principal residence, except for business purposes

Keep in mind that the Residential Clean Energy Credit and the Alternative Fuel Vehicle Refueling Credit do not include upgrades. All three programs will remain in effect through December 31, 2032.

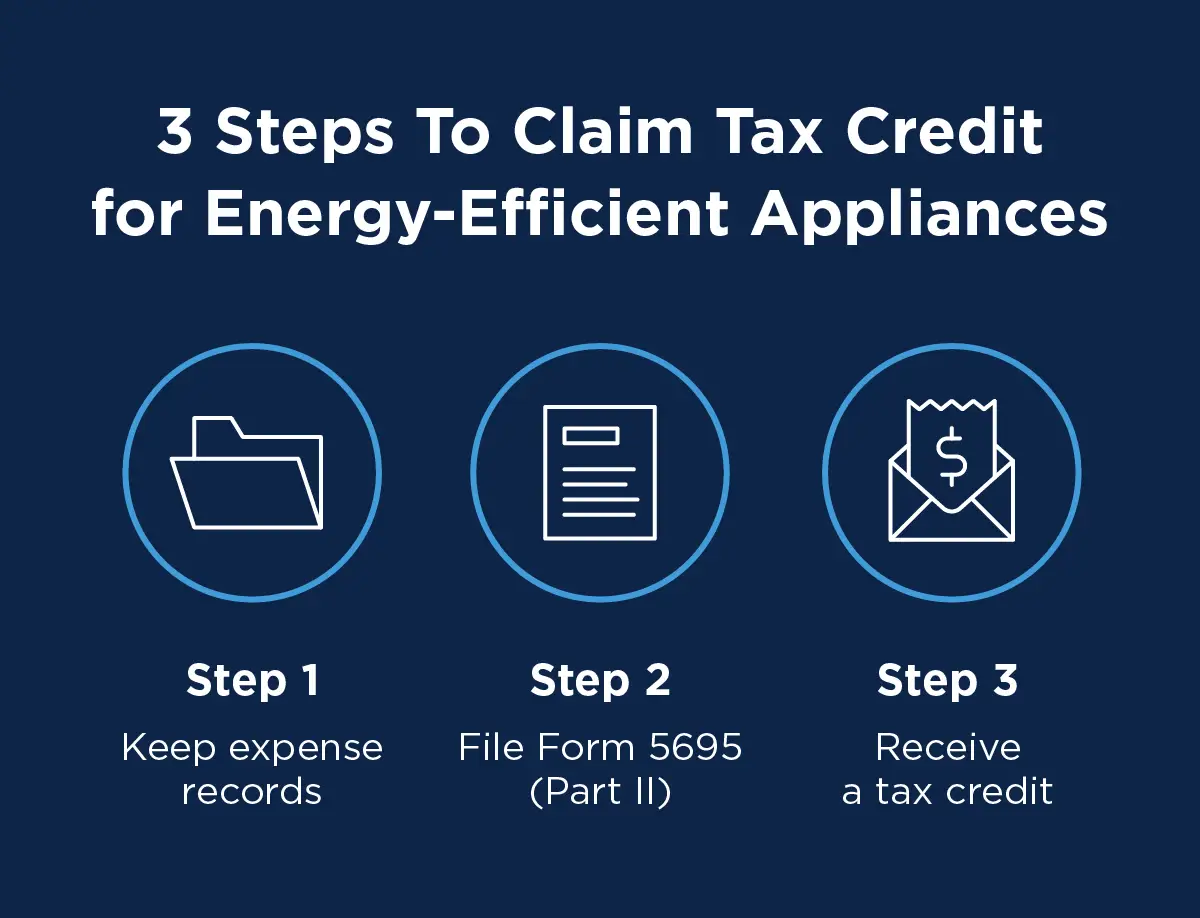

How To Claim Tax Credit for Energy-Efficient Systems

To claim a tax credit for qualifying energy-efficient systems, fill out IRS Form 5695 (Part II) when you file your federal income taxes.

Remember, you must claim your energy-efficient tax credit in the year the system was installed (not just purchased). Any qualifying systems installed on or after January 1, 2023, and before January 1, 2033, are eligible.

However, if an accountant or other tax preparer files your taxes each year, consult with them on how to claim tax credits for energy-efficient systems or submit a deduction. Tax credit qualifications and requirements do change, so it’s always best to keep track of your energy- and system-related costs and stay up-to-date on the latest requirements so you don’t miss an opportunity for a tax break!

Other Incentives for Energy-Efficient Systems

Some state or local governments offer incentives or special programs for energy-efficient systems. These incentives are unrelated to taxes. The DOE funds and maintains a large database called DSIRE®, where you can search for policies and incentives at the city, state, federal, and utility levels. Search by ZIP code to find out how to claim incentives for your energy-efficient systems in any of these categories.

A less tangible incentive for using an energy-efficient system is the knowledge that you’re doing your part to reduce your carbon footprint.

Finally, have your HVAC system routinely maintained so they perform at peak efficiency. Your local Aire Serv is ready to provide outstanding service to prolong more expensive repairs and maintenance down the line.

Maintain and Repair Energy-Efficient Systems

When you’re researching what HVAC systems qualify for an energy tax credit, looking for an ENERGY STAR certification is a good place to start. And to keep your HVAC systems in tip-top shape for as long as possible, rely on the experts at your local Aire Serv. With regular maintenance, your system will continue to perform efficiently, maximizing energy efficiency.

Our service professionals have the experience and expertise to repair all major brands of HVAC systems. So, if you need HVAC repairs or maintenance, contact your local Aire Serv today.

This article is intended for general guidance only and is not applicable to every situation. You are responsible for determining the proper course of action for your property and situation. Aire Serv is not responsible for any damages that occur as a result of advice and/or guidance derived from its blog content.

Aire Serv services may vary by location. Contact the Aire Serv franchise nearest you for more information.

FAQ About the Energy Tax Credit

Still have questions about what systems qualify for the energy tax credit? The experienced service professionals at Aire Serv have answers.

How Do You Claim Energy-Efficient Tax Credits on Your Tax Return?

To claim energy tax credits, you have to fill out special forms when you file your federal income taxes:

- Form 5695: Claim the credit for the tax year when the system or other equipment was installed (not just purchased).

- Form 8911: Calculate your credit for Alternative Fuel Vehicle Refueling Credit. Review the instructions for details.

When in doubt about your eligibility, consult a tax professional for expert advice

What Type of HVAC System and Components Can You Claim on Taxes?

Eligible systems and components you can claim on your taxes include:

- Biomass stoves and boilers

- Air source heat pumps

- Heat pump and natural gas water heaters

- Natural gas boilers

- Natural gas and oil furnaces

- Central air conditioners

Can You Write Off a New Washer and Dryer on Taxes?

No, washers and dryers do not qualify for an energy tax credit, but ENERGY STAR-certified electric heat pump clothes dryers may be eligible for rebates under the High-Efficiency Electric Home Rebate Program in the future. Check the Energy Efficient Home Improvement Credit for more details.

Click to call

Click to call